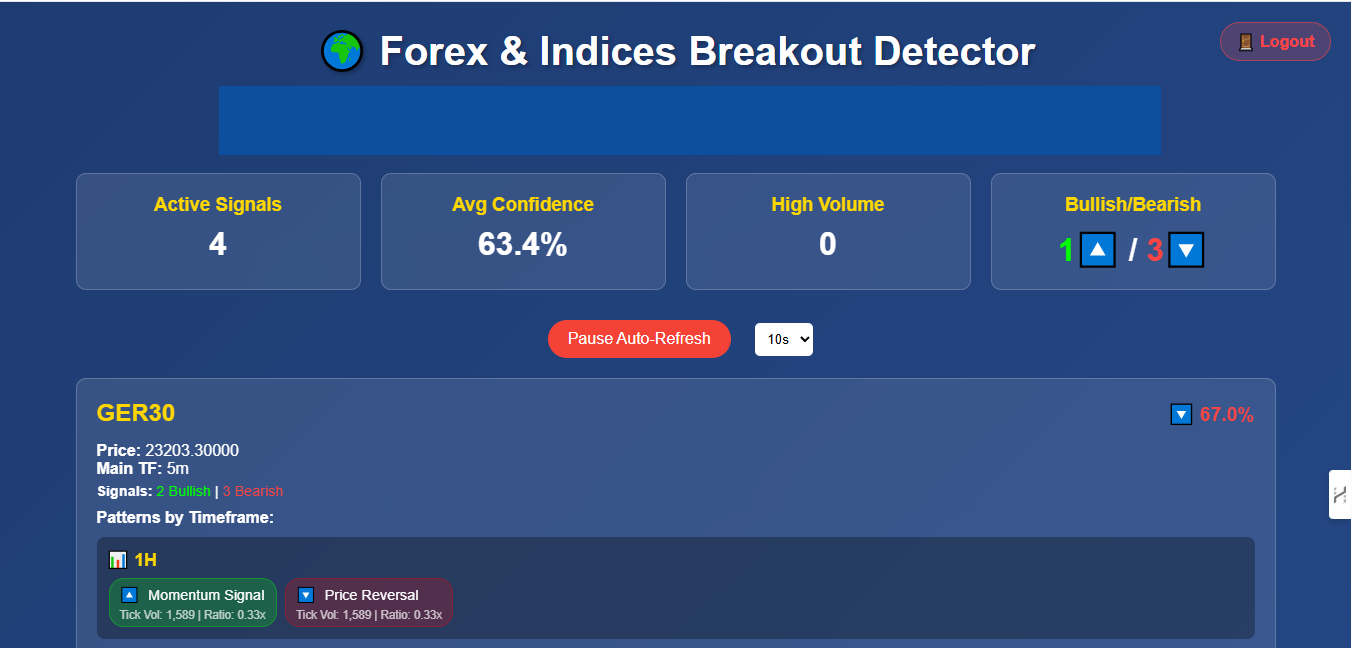

How It Works

The tool continuously analyzes price action across multiple timeframes to identify significant support and resistance levels. When price closes beyond these key levels, it displays the breakout signal on your dashboard with a probability score, confirming that market structure is shifting.

How to Use It

Monitor the dashboard for high-probability breakout signals to identify potential trade entries at the beginning of new trends. The tool removes the subjectivity of manually drawing support and resistance lines by automatically detecting and ranking breakout opportunities based on technical analysis and machine learning.