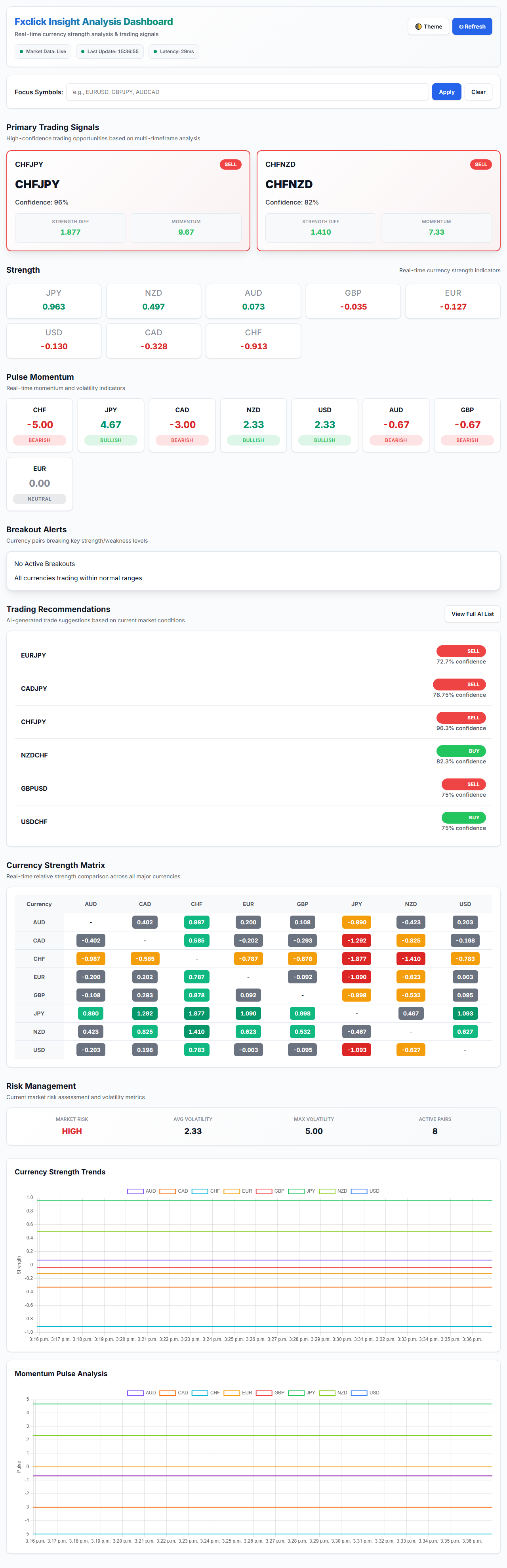

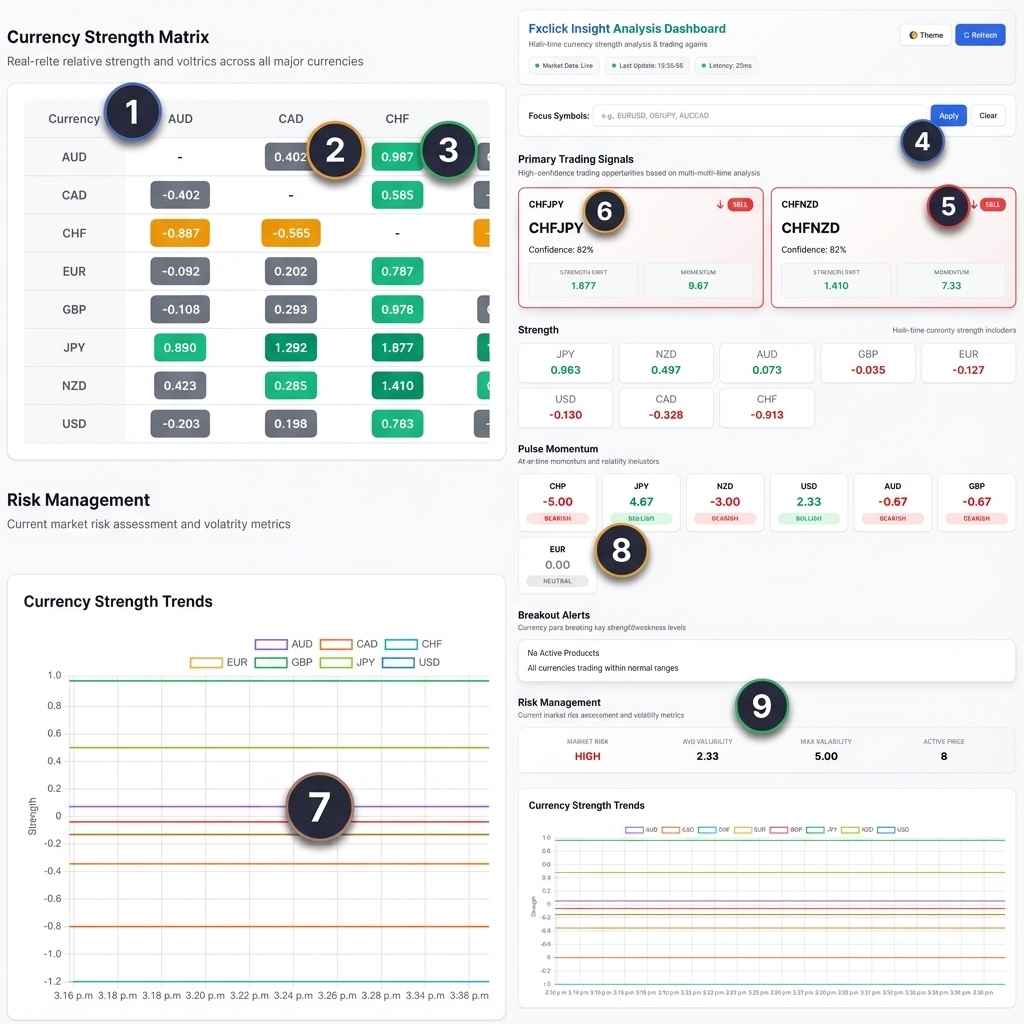

Understanding the Currency Strength Meter

The Currency Strength Meter is a powerful analytical tool that evaluates and ranks the relative strength of major currencies (USD, EUR, GBP, JPY, AUD, NZD, CAD, CHF) in real-time. Unlike traditional chart analysis that focuses on individual pairs, this tool provides a bird's-eye view of the entire forex market.

How It Works

The meter calculates strength scores by analyzing price movements across all major currency pairs. Each currency receives a score based on its performance against all other currencies. A high score indicates strength (appreciating), while a low score indicates weakness (depreciating).

Trading Strategy

The Golden Rule: Trade pairs where there's maximum divergence between strength and weakness.

- Strong Buy Signal: Pair the strongest currency with the weakest (e.g., if USD is strongest and JPY is weakest, consider buying USD/JPY)

- Avoid Choppy Markets: Don't trade pairs where both currencies have similar strength scores

- Confirm Trends: Use the strength meter alongside your technical analysis for higher probability setups

- Monitor Changes: Watch for strength divergences that persist over multiple timeframes for the most reliable signals